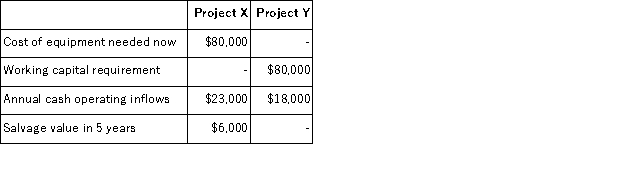

The Sawyer Corporation has $80,000 to invest and is considering two different projects, X and Y. The following data are available on the projects:  Both projects will have a useful life of 5 years; at the end of 5 years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%. The net present value of project Y is closest to:

Both projects will have a useful life of 5 years; at the end of 5 years, the working capital will be released for use elsewhere. Sawyer's discount rate is 12%. The net present value of project Y is closest to:

A) $15,110

B) $30,250

C) $11,708

D) ($11,708)

Correct Answer:

Verified

Q95: The Sawyer Corporation has $80,000 to invest

Q96: The management of Mashiah Corporation is considering

Q97: Betterway Pharmacy has purchased a small auto

Q98: Clairmont Corporation is considering the purchase of

Q99: Westland College has a telephone system that

Q101: Janes, Inc., is considering the purchase of

Q102: The management of Basler Corporation is considering

Q103: Shiffler Corporation is contemplating purchasing equipment that

Q104: Vernon Corporation has been offered a 5-year

Q105: Bill Anders retires in 5 years. He

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents