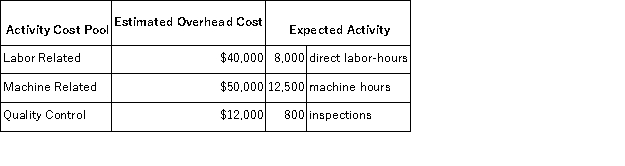

Swagg Jewelry Corporation manufactures custom jewelry. In the past, Swagg has been using a traditional overhead allocation system based solely on direct labor-hours. Sensing that this system was distorting costs and selling prices, Swagg has decided to switch to an activity-based costing system using three activity cost pools. Information on these activity cost pools are as follows:  Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Required:

a. What is the cost of the job under the activity-based costing system?

b. Relative to the activity-based costing system, would Job #309 have been overcosted or undercosted under the traditional system and by how much?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q198: Besser, Inc., manufactures and sells two products:

Q199: Dameron, Inc., manufactures and sells two products:

Q200: Mahaxay, Inc., manufactures and sells two products:

Q201: Hammer, Inc., manufactures and sells two products:

Q202: Mouret Corporation uses the following activity rates

Q203: Overmeyer, Inc., manufactures and sells two products:

Q204: Garhart Corporation uses the following activity rates

Q206: Gribbins, Inc., manufactures and sells two products:

Q207: Villeda Corporation uses the following activity rates

Q208: Uson, Inc., manufactures and sells two products:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents