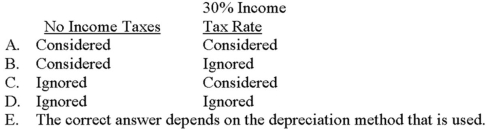

Assume that a capital project is being analyzed by a discounted-cash-flow approach, and an employee first assumes no income taxes and then later assumes a 30% income tax rate. How would depreciation expense be incorporated in the analysis?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Q37: A company's cash flows for income taxes

Q39: When income taxes are considered in capital

Q42: The rule for project acceptance under the

Q42: Bath Works Company has $70,000 of depreciation

Q43: Hazeldine Company plans to incur $230,000 of

Q45: The net-present-value method assumes that project funds

Q45: Puck Company received $18,000 cash from the

Q52: Consider the following statements about capital budgeting

Q64: A depreciation tax shield is a(n):

A) after-tax

Q70: A company used the net-present-value method to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents