Eagle Airways Company is planning a project that is expected to last for six years and generate annual net cash inflows of $75,000. The project will require the purchase of a $280,000 machine, which is expected to have a salvage value of $10,000 at the end of the six-year period. The machine will require a $50,000 overhaul at the end of the fourth year. The company presently has a 12% minimum desired rate of return.

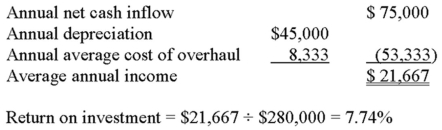

Based on this information, an accountant prepared the following analysis:

The accountant recommends that the project be rejected because it does not meet the company's minimum desired rate of return. Ignore income taxes.

Required:

A. What criticism(s) would you make of the accountant's evaluation?

B. Use the net-present-value method and determine whether the project should be accepted.

C. Based on your answer in requirement "B," is the internal rate of return greater or less than 12%? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: A cash flow measured in real dollars:

A)

Q93: Cones & Moore sells frozen custard and

Q94: The Warren Machine Tool Company is considering

Q95: Lasley Corporation is considering the acquisition of

Q96: Perez Corporation recently purchased a $1,200,000 asset

Q97: Spiers Corporation is considering the acquisition of

Q99: Wexford Corporation is considering the acquisition of

Q101: A profitability index can be used to

Q102: The payback method is a popular way

Q103: Depreciation is often described as a "tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents