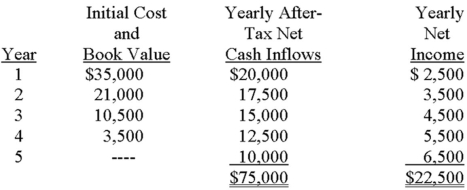

Ivory Corporation is reviewing an investment proposal that has an initial cost of $52,500. An estimate of the investment's end-of-year book value, the yearly after-tax net cash inflows, and the yearly net income are presented in the schedule below. Yearly after-tax net cash inflows include savings from the depreciation tax shield. The investment's salvage value at the end of each year is equal to book value, and there will be no salvage value at the end of the investment's life.

Ivory uses a 14% after-tax target rate of return for new investment proposals.

Required:

A. Calculate the project's payback period.

B. Calculate the accounting rate of return on the initial investment.

C. Calculate the proposal's net present value. Round to the nearest dollar.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Harrison Township is studying a 700-acre site

Q86: Postaudits are an important part of capital

Q87: Custom Plastics plans to purchase $4.5 million

Q88: Wornell Industries is currently purchasing part no.

Q89: Mark Industries is currently purchasing part no.

Q91: Consider the five items that follow, which

Q92: Grey is considering the replacement of some

Q93: Cones & Moore sells frozen custard and

Q94: The Warren Machine Tool Company is considering

Q95: Lasley Corporation is considering the acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents