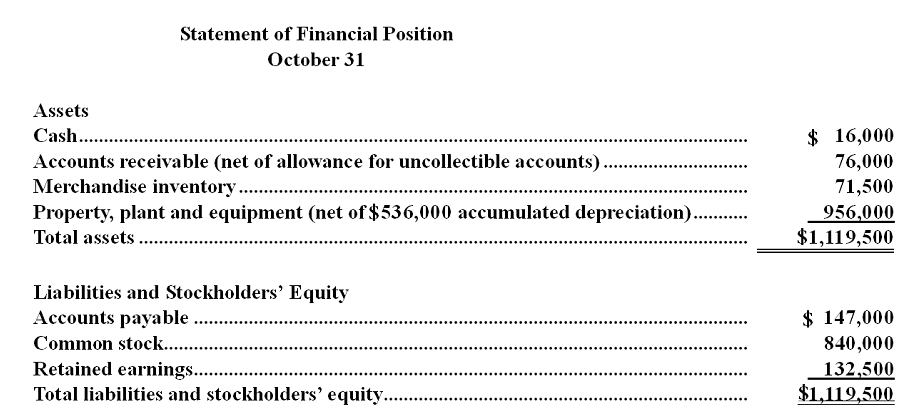

Diltex Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow:

• Sales are budgeted at $220,000 for November, $200,000 for December, and $210,000 for January.

• Collections are expected to be 70% in the month of sale, 27% in the month following the sale, and 3% uncollectible.

• The cost of goods sold is 65% of sales.

• The company desires to have an ending merchandise inventory at the end of each month equal to 50% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $22,500.

• Monthly depreciation is $19,000.

• Ignore taxes.

-Expected cash collections in December are:

A) $59,400

B) $140,000

C) $199,400

D) $200,000

Correct Answer:

Verified

Q21: Lunderville Inc.bases its selling and administrative expense

Q22: Avril Company makes collections on sales according

Q23: The following data have been taken from

Q24: The manufacturing overhead budget at Cutchin Corporation

Q25: The selling and administrative expense budget of

Q27: Hagos Corporation is working on its direct

Q28: Budgeted sales in Allen Company over the

Q29: Shuck Inc.bases its manufacturing overhead budget on

Q30: Berol Company plans to sell 200,000 units

Q31: Diltex Farm Supply is located in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents