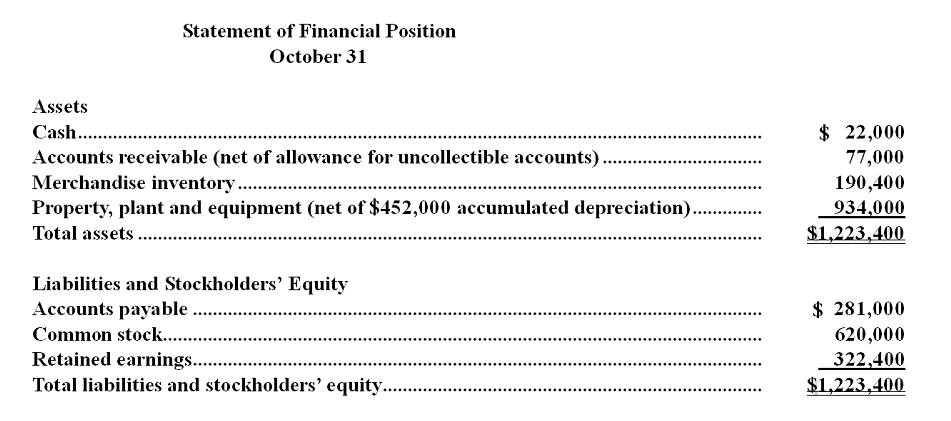

Brarin Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow:

• Sales are budgeted at $340,000 for November, $360,000 for December, and $350,000 for January.

• Collections are expected to be 55% in the month of sale, 44% in the month following the sale, and 1% uncollectible.

• The cost of goods sold is 80% of sales.

• The company would like to maintain ending merchandise inventories equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $23,100.

• Monthly depreciation is $21,000.

• Ignore taxes.

-The difference between cash receipts and cash disbursements in December would be:

A) $17,000

B) $24,300

C) $41,300

D) $65,600

Correct Answer:

Verified

Q41: LHU Corporation makes and sells a product

Q42: Sartain Corporation is in the process of

Q43: Brarin Corporation is a small wholesaler of

Q44: Hardy, Inc., has budgeted sales in units

Q45: Mitchell Company had the following budgeted sales

Q47: Mitchell Company had the following budgeted sales

Q48: Diltex Farm Supply is located in a

Q49: Diltex Farm Supply is located in a

Q50: The Kafusi Company has the following budgeted

Q51: Diltex Farm Supply is located in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents