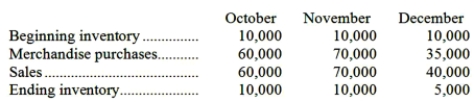

Randall Company is a merchandising company that sells a single product. The company's inventories, production, and sales in units for the next three months have been forecasted as follows:  Units are sold for $12 each. One fourth of all sales are paid for in the month of sale and the balance are paid for in the following month. Accounts receivable at September 30 totaled $450,000.

Units are sold for $12 each. One fourth of all sales are paid for in the month of sale and the balance are paid for in the following month. Accounts receivable at September 30 totaled $450,000.

Merchandise is purchased for $7 per unit. Half of the purchases are paid for in the month of the purchase and the remainder are paid for in the month following purchase. Selling and administrative expenses are expected to total $120,000 each month. One half of these expenses will be paid in the month in which they are incurred and the balance will be paid in the following month. There is no depreciation. Accounts payable at September 30 totaled $290,000.

Cash at September 30 totaled $80,000. A payment of $300,000 for purchase of equipment is scheduled for November, and a dividend of $200,000 is to be paid in December.

Required:

a. Prepare a schedule of expected cash collections for each of the months of October, November, and December.

b. Prepare a schedule showing expected cash disbursements for merchandise purchases and selling and administrative expenses for each of the months October, November, and December.

c. Prepare a cash budget for each of the months October, November, and December. There is no minimum required ending cash balance.

Correct Answer:

Verified

Q82: Dengel Inc. is working on its cash

Q87: Carpon Lumber sells lumber and general building

Q88: The Gomez Company, a merchandising firm, has

Q91: Porl Corporation makes and sells a single

Q93: Carpon Lumber sells lumber and general building

Q96: Capati Corporation is working on its direct

Q97: Porl Corporation makes and sells a single

Q98: Carpon Lumber sells lumber and general building

Q99: The Gomez Company, a merchandising firm, has

Q100: Dengel Inc. is working on its cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents