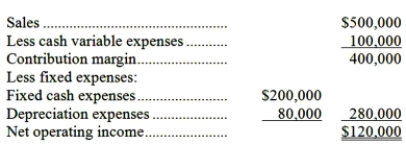

(Ignore income taxes in this problem.) Rogers Company is studying a project that would have a ten-year life and would require an $800,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 8%. What is the payback period for this project?

The company's required rate of return is 8%. What is the payback period for this project?

A) 3 years

B) 6.67 years

C) 2 years

D) 4 years

Correct Answer:

Verified

Q63: (Ignore income taxes in this problem. )Buy-Rite

Q68: (Ignore income taxes in this problem. )The

Q72: (Ignore income taxes in this problem.)

Q78: (Ignore income taxes in this problem.) Czaplinski

Q80: (Ignore income taxes in this problem. )An

Q83: (Ignore income taxes in this problem.) Lichty

Q90: (Ignore income taxes in this problem.) Bugle's

Q91: (Ignore income taxes in this problem.) Bugle's

Q93: (Ignore income taxes in this problem.) Gillaspie,

Q95: (Ignore income taxes in this problem.) Gillaspie,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents