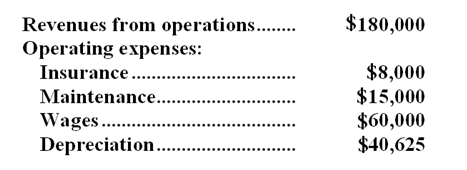

(Ignore income taxes in this problem.) The Crawford Company is pondering an investment in a machine that costs $350,000, that will have a useful life of eight years, and that will have a salvage value of $25,000. If this machine is purchased, a similar, old machine will be sold at a salvage value of $40,000. The anticipated yearly revenues and expenses associated with the new machine are:  All of the revenues and expenses except depreciation are for cash. The company's required rate of return is 12%. The annual cash flows occur uniformly throughout the year.

All of the revenues and expenses except depreciation are for cash. The company's required rate of return is 12%. The annual cash flows occur uniformly throughout the year.

-The simple rate of return,to the nearest tenth of a percent,of this investment is:

A) 18.2%

B) 16.1%

C) 31.3%

D) 27.7%

Correct Answer:

Verified

Q101: (Ignore income taxes in this problem.)

Q102: (Ignore income taxes in this problem.) The

Q103: (Ignore income taxes in this problem.) The

Q104: (Ignore income taxes in this problem.) The

Q105: (Ignore income taxes in this problem.) The

Q107: (Ignore income taxes in this problem. )Farah

Q108: (Ignore income taxes in this problem.)

Q109: (Ignore income taxes in this problem. )Bill

Q110: (Ignore income taxes in this problem. )Dunay

Q111: (Ignore income taxes in this problem.)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents