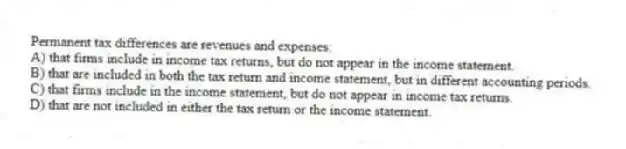

Permanent tax differences are revenues and expenses:

A) that firms include in income tax returns, but do not appear in the income statement.

B) that are included in both the tax return and income statement, but in different accounting periods.

C) that firms include in the income statement, but do not appear in income tax returns.

D) that are not included in either the tax return or the income statement.

Correct Answer:

Verified

Q3: Disregarding cash flows with owners,over sufficiently long

Q4: Future tax deductions:

A) result in deferred tax

Q5: The income statement approach to measuring income

Q6: At origination which of the following temporary

Q7: Plaxo Corporation has a tax rate of

Q9: When income tax expense for a period

Q10: Shareholders' equity consists of what three components:

A)

Q11: Which of the following transactions is consistent

Q12: Which of the following valuation methods reflects

Q13: Current replacement cost represents:

A) the amount a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents