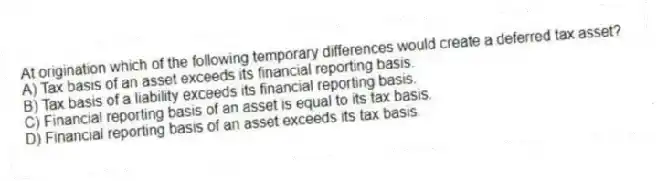

At origination which of the following temporary differences would create a deferred tax asset?

A) Tax basis of an asset exceeds its financial reporting basis.

B) Tax basis of a liability exceeds its financial reporting basis.

C) Financial reporting basis of an asset is equal to its tax basis.

D) Financial reporting basis of an asset exceeds its tax basis.

Correct Answer:

Verified

Q1: Fish Farm Corporation purchases a new tract

Q2: Interest on Municipal Bonds represents what kind

Q3: Disregarding cash flows with owners,over sufficiently long

Q4: Future tax deductions:

A) result in deferred tax

Q5: The income statement approach to measuring income

Q7: Plaxo Corporation has a tax rate of

Q8: Permanent tax differences are revenues and expenses:

A)

Q9: When income tax expense for a period

Q10: Shareholders' equity consists of what three components:

A)

Q11: Which of the following transactions is consistent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents