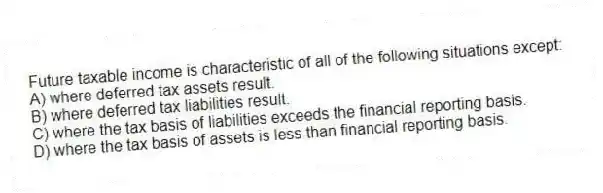

Future taxable income is characteristic of all of the following situations except:

A) where deferred tax assets result.

B) where deferred tax liabilities result.

C) where the tax basis of liabilities exceeds the financial reporting basis.

D) where the tax basis of assets is less than financial reporting basis.

Correct Answer:

Verified

Q10: Shareholders' equity consists of what three components:

A)

Q11: Which of the following transactions is consistent

Q12: Which of the following valuation methods reflects

Q13: Current replacement cost represents:

A) the amount a

Q14: The net amount a firm would receive

Q16: Firms use acquisition cost valuations and adjusted

Q17: The traditional accounting model delays the recognition

Q18: The use of acquisition cost as a

Q19: Which of the following assets appears on

Q20: Which of the following is not one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents