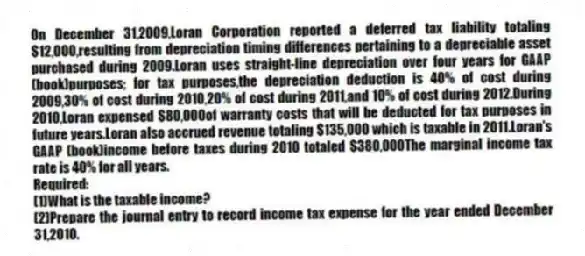

On December 31,2009,Loran Corporation reported a deferred tax liability totaling $12,000,resulting from depreciation timing differences pertaining to a depreciable asset purchased during 2009.Loran uses straight-line depreciation over four years for GAAP (book)purposes; for tax purposes,the depreciation deduction is 40% of cost during 2009,30% of cost during 2010,20% of cost during 2011,and 10% of cost during 2012.During 2010,Loran expensed $80,000of warranty costs that will be deducted for tax purposes in future years.Loran also accrued revenue totaling $135,000 which is taxable in 2011.Loran's GAAP (book)income before taxes during 2010 totaled $380,000The marginal income tax rate is 40% for all years.

Required:

(1)What is the taxable income?

(2)Prepare the journal entry to record income tax expense for the year ended December 31,2010.

Correct Answer:

Verified

(2)

* Warranty expense timing differ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q68: For some transactions GAAP requires that value

Q69: Discuss the two principal reasons income before

Q70: The following problem requires present value information:

Biotech

Q71: On January 1,2010,Starlight Company's balance sheet reported

Q72: The analytical framework used to evaluate

Q74: a.Plaxo Corporation has a tax rate of

Q75: Jurgen Company's income tax return shows income

Q76: The analytical framework used to evaluate

Q77: The analytical framework used to evaluate

Q78: There are three valuation methods that reflect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents