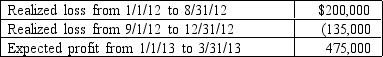

On September 1,2012,Ramos Inc.approved a plan to dispose of a segment of its business.Ramos expected that the sale would occur on March 31,2013,at an estimated gain of $375,500.The segment had actual and estimated operating profits (losses as follows):

Assume a marginal tax rate of 35%

Assume a marginal tax rate of 35%

Required:

A)In its 2012 income statement,what should Ramos report as profit or loss from discontinued operations (net of tax effects)?

B)Calculate the amount of income that should be shown on the 2013 income statement as a result of the operating profit and the gain on disposal (net of tax)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: In bankruptcy prediction analysis,a type _ error

Q48: When evaluating the quality of accounting information

Q52: Gains and losses differ from revenues and

Q62: Achieving comparability in financial reporting is important

Q63: A company may try to paint a

Q65: On July 15,2009 Time Services decided to

Q66: Many times an analyst will have to

Q66: Motor Corporation's income statements for the years

Q67: Healy and Wahlen state that one type

Q75: Healy and Wahlen state that one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents