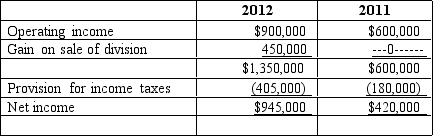

Motor Corporation's income statements for the years ended December 31,2012 and 2011 included the following information before adjustments:

On January 1,2012,Motor Corporation agreed to sell the assets and product line of one of its operating divisions for $1,600,000.The sale was consummated on December 31,2012,and it resulted in a gain on disposition of $450,000.This division's pre-tax net losses were $320,000 in 2012 and $250,000 in 2011.The income tax rate for both years was 30%.

On January 1,2012,Motor Corporation agreed to sell the assets and product line of one of its operating divisions for $1,600,000.The sale was consummated on December 31,2012,and it resulted in a gain on disposition of $450,000.This division's pre-tax net losses were $320,000 in 2012 and $250,000 in 2011.The income tax rate for both years was 30%.

Required:

Starting with operating income (before tax),prepare revised comparative income statements for 2012 and 2011 showing appropriate details for gain (loss)from discontinued operations.

Correct Answer:

Verified

Q52: Gains and losses differ from revenues and

Q62: Achieving comparability in financial reporting is important

Q62: On September 1,2012,Ramos Inc.approved a plan to

Q63: A company may try to paint a

Q65: On July 15,2009 Time Services decided to

Q67: Healy and Wahlen state that one type

Q70: For each of the following factors,determine if

Q71: On November 15,2012,Jacobs Co.sold a segment of

Q73: Many users of financial statements believe that

Q75: Healy and Wahlen state that one type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents