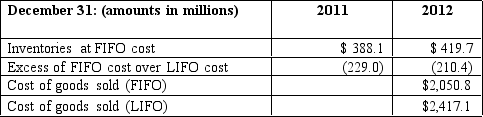

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: A company that uses LIFO will experience

Q55: The process of allocating the historical cost

Q62: Bower Construction Comp.has consistently used the percentage-of-

Q63: The following information is related to the

Q64: Magnum Construction contracted to construct a factory

Q68: Under U.S.GAAP,application of the LIFO and FIFO

Q69: What are the four disclosures required by

Q69: Given the following information,compute December 31,2012 projected

Q73: What are the five steps to apply

Q78: Explain the difference between a temporary and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents