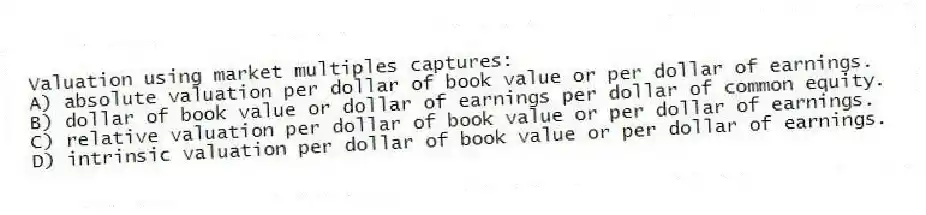

Valuation using market multiples captures:

A) absolute valuation per dollar of book value or per dollar of earnings.

B) dollar of book value or dollar of earnings per dollar of common equity.

C) relative valuation per dollar of book value or per dollar of earnings.

D) intrinsic valuation per dollar of book value or per dollar of earnings.

Correct Answer:

Verified

Q6: Strictly speaking,the price-earnings ratio assumes that firm

Q7: One problem with the price-earnings ratio commonly

Q8: Under the value-to-book model a firm will

Q9: Under the value-to-book model new projects will

Q10: Which of the following normally does not

Q12: Trading on the equity is likely to

Q13: Wolverwine Company's current stock price is $55

Q14: Which of the following is not a

Q15: Which of the following ratios usually reflects

Q16: Firms with low P/E ratios tend to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents