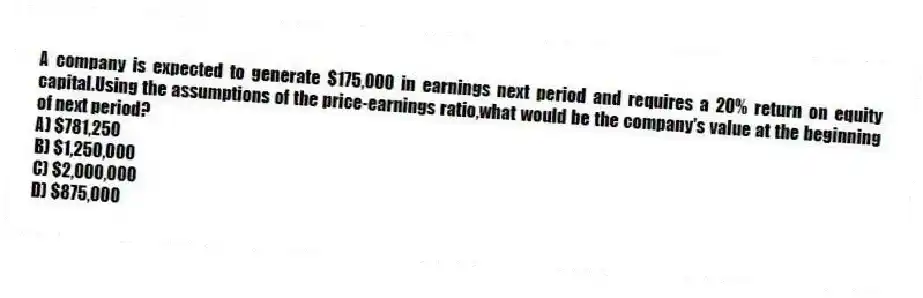

A company is expected to generate $175,000 in earnings next period and requires a 20% return on equity capital.Using the assumptions of the price-earnings ratio,what would be the company's value at the beginning of next period?

A) $781,250

B) $1,250,000

C) $2,000,000

D) $875,000

Correct Answer:

Verified

Q13: Wolverwine Company's current stock price is $55

Q14: Which of the following is not a

Q15: Which of the following ratios usually reflects

Q16: Firms with low P/E ratios tend to

Q17: Companies value-to-book and market-to-book ratios may differ

Q19: Assuming that Ska Company's cost of equity

Q20: A company with a PEG ratio of

Q21: In the value-to-book model growth adds value

Q22: The risk of the firm increases the

Q23: Economics teaches that,in equilibrium,firms will earn a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents