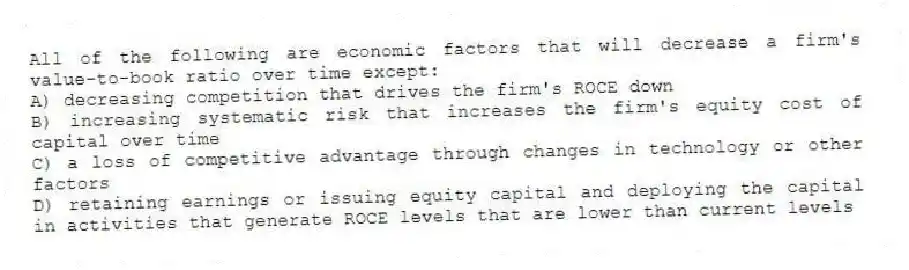

All of the following are economic factors that will decrease a firm's value-to-book ratio over time except:

A) decreasing competition that drives the firm's ROCE down

B) increasing systematic risk that increases the firm's equity cost of capital over time

C) a loss of competitive advantage through changes in technology or other factors

D) retaining earnings or issuing equity capital and deploying the capital in activities that generate ROCE levels that are lower than current levels

Correct Answer:

Verified

Q31: Industries with relatively high market-to-book ratios are

Q32: The value-to-book ratio reflects an analyst's expectation

Q33: All of the following are economic factors

Q34: The theoretical PE model does not work

Q35: Which of the following ratios give a

Q37: All of the following are accounting factors

Q38: Analysts use the PEG ratio to assess

Q39: The value-to-book model indicates that a firm

Q40: The market price of a share of

Q41: In research examining market efficiency,Bernard and Thomas

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents