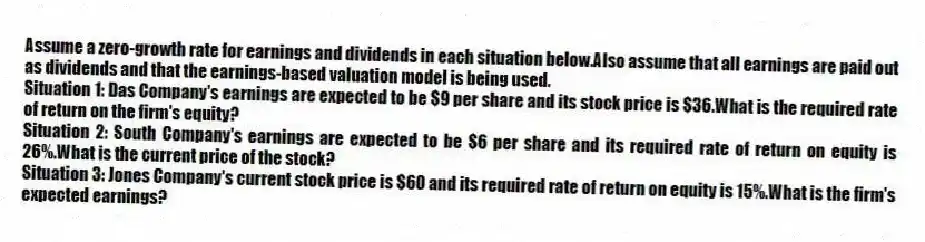

Assume a zero-growth rate for earnings and dividends in each situation below.Also assume that all earnings are paid out as dividends and that the earnings-based valuation model is being used.

Situation 1: Das Company's earnings are expected to be $9 per share and its stock price is $36.What is the required rate of return on the firm's equity?

Situation 2: South Company's earnings are expected to be $6 per share and its required rate of return on equity is 26%.What is the current price of the stock?

Situation 3: Jones Company's current stock price is $60 and its required rate of return on equity is 15%.What is the firm's expected earnings?

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: A firm's value-to-book and market-to-book ratios may

Q52: What is the value of reverse engineering

Q53: Investors have invested $30,000 in common equity

Q54: The use of P/E ratios in valuation

Q55: Firms with low P/E ratios tend to

Q57: What is a price differential and how

Q58: Discuss how risk and profitability factors cause

Q59: Assume an analyst is evaluating a

Q60: Why is book value often meaningless? What

Q61: Use the following information to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents