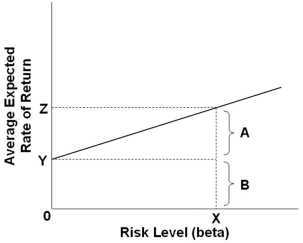

Refer to the graph above. The bracket B represents the:

Refer to the graph above. The bracket B represents the:

A) Amount of arbitrage for this asset

B) Rate of return for the market portfolio

C) Risk premium for an asset's risk level

D) Compensation for time preference for an asset

Correct Answer:

Verified

Q79: A strategy that attempts to reduce the

Q80: What does the 'beta' of an asset

Q81: The Security Market Line (SML) is upward-sloping,

Q82: The so-called risk-free rate essentially measures the

Q83: If the Federal Reserve uses open-market operations

Q85: If an asset has a risk-return combination

Q86: The vertical intercept of the Security Market

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents