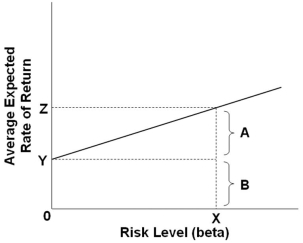

Refer to the graph above. The risk premium for an asset with a beta equal to X would be:

Refer to the graph above. The risk premium for an asset with a beta equal to X would be:

A) Z

B) A plus B

C) Z minus B

D) Z minus A

Correct Answer:

Verified

Q82: The so-called risk-free rate essentially measures the

Q83: If the Federal Reserve uses open-market operations

Q84: Q85: If an asset has a risk-return combination Q86: The vertical intercept of the Security Market Q88: If an asset has a risk-return combination Q89: The Security Market line (SML) shows how Q90: Short-term U.S. government securities are practically risk-free Q91: The Fed can regularly influence and change Q92: People tend to be impatient, and they![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents