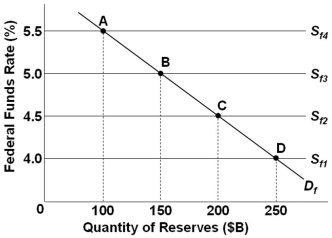

Refer to the figure above. If the Federal funds market is at equilibrium at point C and the Federal Reserve decides to conduct an open-market sale, then it must be trying to set a:

Refer to the figure above. If the Federal funds market is at equilibrium at point C and the Federal Reserve decides to conduct an open-market sale, then it must be trying to set a:

A) Higher target federal funds rate by increasing the amount of reserves in the market

B) Higher target federal funds rate by reducing the amount of reserves in the market

C) Lower target federal funds rate by increasing the amount of reserves in the market

D) Lower target federal funds rate by reducing the amount of reserves in the market

Correct Answer:

Verified

Q67: The most recently-introduced tool of monetary policy

Q68: In a supply-and-demand graph for the Federal

Q69: Lowering the discount rate has the effect

Q71: Assume that the required reserve ratio is

Q73: Assume that the required reserve ratio is

Q74: What policy tool of the Federal Reserve

Q75: Raising the interest paid on reserves has

Q76: Assume the commercial banking system has checkable

Q77: If the Fed reduces the interest paid

Q255: Assume that the required reserve ratio for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents