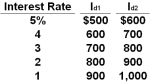

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.  Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

A) $0

B) $100 billion

C) $600 billion

D) $700 billion

Correct Answer:

Verified

Q123: A major concern with the Social Security

Q124: Q125: In the later part of 2009, something Q126: The Social Security Program is designed to Q129: The following is an investment schedule. Investment Q130: Medicare and Social Security are similar in Q226: If the government wants to reduce unemployment Q228: The goal of expansionary fiscal policy is Q235: Expansionary fiscal policy during a recession means Q237: A decrease in government spending and a![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents