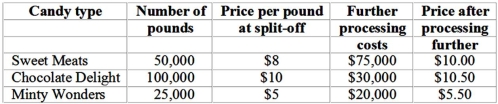

Great Sweets Candy Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  If Chocolate Delight is processed further,the gross profit margin that will appear in a product line income statement for Chocolate Delight would be:

If Chocolate Delight is processed further,the gross profit margin that will appear in a product line income statement for Chocolate Delight would be:

A) $734,286.

B) $520,000.

C) $1,020,000.

D) $632,596.

Correct Answer:

Verified

Q23: Which of the following statements is false

Q37: Which of the following would be an

Q40: Which of the following statements is true

Q66: For the purposes of allocating joint costs

Q89: Brandeis Corporation has two production Departments: P1

Q90: Brandeis Corporation has two production Departments: P1

Q94: Great Sweets Candy Company produces various types

Q96: In joint product costing and analysis,which one

Q97: Which of the following statements about maximizing

Q102: Which of the following statements regarding accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents