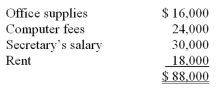

Terri Martin,CPA provides bookkeeping and tax services to her clients.She charges a fee of $60 per hour for bookkeeping and $90 per hour for tax services.Martin estimates the following costs for the upcoming year:  Operating profits declined last year and Ms.Martin has decided to use activity-based costing (ABC) procedures to evaluate her hourly fees.She gathered the following information from last year's records:

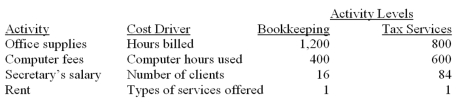

Operating profits declined last year and Ms.Martin has decided to use activity-based costing (ABC) procedures to evaluate her hourly fees.She gathered the following information from last year's records:  A major client has requested bookkeeping services.However,Martin is already billing 100% of her capacity (i.e. ,2,000 hours per year) and would need to shift 100 hours from her tax services to meet this client's request.What is the minimum fee per hour that Martin could charge this client for bookkeeping services and be no worse off than last year?

A major client has requested bookkeeping services.However,Martin is already billing 100% of her capacity (i.e. ,2,000 hours per year) and would need to shift 100 hours from her tax services to meet this client's request.What is the minimum fee per hour that Martin could charge this client for bookkeeping services and be no worse off than last year?

A) $48.75.

B) $60.00.

C) $81.25.

D) $90.00.

Correct Answer:

Verified

Q45: Terri Martin,CPA provides bookkeeping and tax services

Q46: Smelly Perfume Company manufactures and distributes several

Q47: Smelly Perfume Company manufactures and distributes several

Q48: Smelly Perfume Company manufactures and distributes several

Q49: RS Company manufactures and distributes two products,R

Q51: RS Company manufactures and distributes two products,R

Q52: Terri Martin,CPA provides bookkeeping and tax services

Q53: RS Company manufactures and distributes two products,R

Q54: Smelly Perfume Company manufactures and distributes several

Q55: Terri Martin,CPA provides bookkeeping and tax services

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents