-Which of the following are considered ad valorem taxes?

A) taxes assessed by charging a rate equal to a percentage of an item's price

B) taxes assessed by charging a flat amount per unit purchased

C) taxes based on the amount of debt that the government must repay

D) taxes based on the amount of spending the government will undertake

Correct Answer:

Verified

Q137: A 5 percent tax is going to

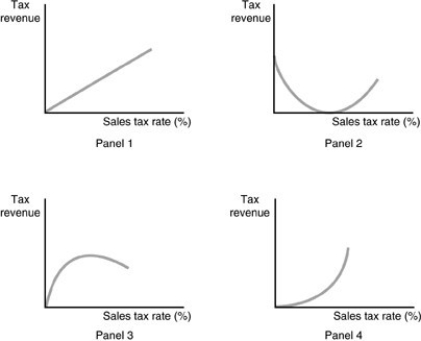

Q138: If the government wishes to maximize its

Q139: Static tax analysis assumes that

A) an increase

Q140: A local government currently has a tax

Q141: Dynamic tax analysis is an economic evaluation

Q143: A government is thinking about increasing the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents