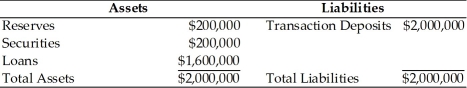

-Based on the above table, an open market operation in which the Fed purchased $200,000 of government securities would

A) create a reserve deficiency for the banking system.

B) lead to a maximum potential expansion of the money supply of $200,000.

C) lead to a maximum potential expansion of the money supply of $2 million.

D) cause demand deposits to fall by $200,000.

Correct Answer:

Verified

Q385: The reserve ratio is 20 percent and

Q386: Q387: Which of the following is NOT an Q388: The initial impact of the Fed's open Q389: If the actual money multiplier equals the Q391: When the Fed buys a U.S. bond Q392: If the actual money multiplier equals the Q393: The Federal Open Market Committee has responsibility Q394: The Fed sells a U.S. government security Q395: Open market operations are![]()

A) the buying of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents