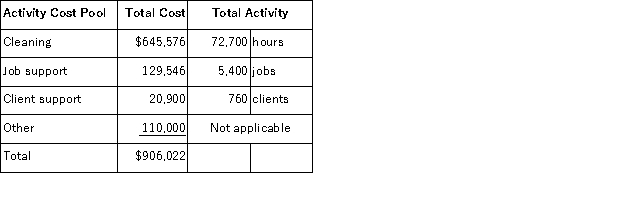

Duckhorn Housecleaning provides housecleaning services to its clients.The company uses an activity-based costing system for its overhead costs.The company has provided the following data from its activity-based costing system.  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

One particular client, the Lumbard family, requested 31 jobs during the year that required a total of 62 hours of housecleaning.For this service, the client was charged $1, 620.

Required:

a.Compute the activity rates (i.e. , cost per unit of activity)for the activity cost pools.Round off all calculations to the nearest whole cent.

b.Using the activity-based costing system, compute the customer margin for the Lumbard family.Round off all calculations to the nearest whole cent.

c.Assume the company decides instead to use a traditional costing system in which all costs are allocated to customers on the basis of cleaning hours.Compute the margin for the Lumbard family.Round off all calculations to the nearest whole cent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: Stroth Corporation uses activity-based costing to compute

Q118: Carsten Wedding Fantasy Corporation makes very elaborate

Q119: The controller of Hartis Corporation estimates the

Q120: Koutz Corporation uses activity-based costing to compute

Q121: Vassallo Corporation's activity-based costing system has three

Q123: Data concerning three of Falkenstein Corporation's activity

Q124: The following data have been provided by

Q125: Swagg Jewelry Corporation manufactures custom jewelry.In the

Q126: Schulenburg Corporation has provided the following data

Q127: Foradori Corporation's activity-based costing system has three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents