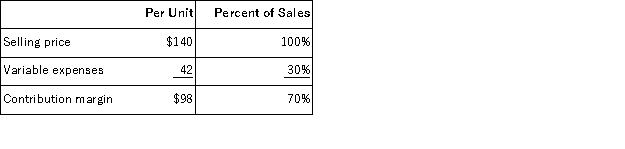

Hartung Corporation produces and sells a single product.Data concerning that product appear below:  Fixed expenses are $147, 000 per month.The company is currently selling 2, 000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $13 per unit.In exchange, the sales staff would accept a decrease in their salaries of $22, 000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147, 000 per month.The company is currently selling 2, 000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $13 per unit.In exchange, the sales staff would accept a decrease in their salaries of $22, 000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $16, 800

B) increase of $226, 000

C) increase of $30, 000

D) decrease of $14, 000

Correct Answer:

Verified

Q24: Contribution margin is the amount remaining after:

A)variable

Q31: Maack Corporation's contribution margin ratio is 16%

Q43: Data concerning Bunck Corporation's single product appear

Q45: Lore Corporation has provided the following information:

Q46: Salley Corporation produces and sells a single

Q46: Carlton Corporation sells a single product at

Q47: Garcia Veterinary Clinic expects the following operating

Q58: Holdt Inc. produces and sells a single

Q59: Steeler Corporation is planning to sell 100,000

Q60: Minist Corporation sells a single product for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents