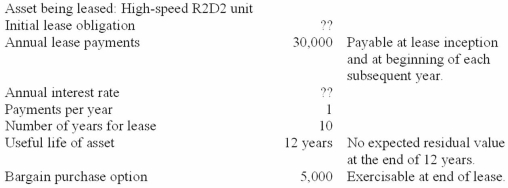

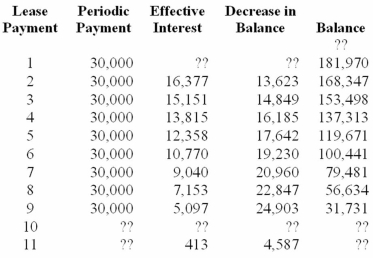

Here is a lease amortization schedule for Jedi Corporation.

Total interest over term of lease. ??

Total interest over term of lease. ??

Annual straight-line depreciation on the leased asset. ??

Required:

(a) Calculate the effective interest and the decrease in balance for the first lease payment.

(b) Calculate the initial lease obligation above.

(c) Calculate the annual depreciation amount. (Round to the nearest dollar.)

(d) Calculate the annual interest rate.

(e) Calculate the missing amounts for rows for payments 10 and 11.

(f) Calculate the total effective interest over the term of the lease.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Nickle leased equipment to Back Company on

Q127: Required:

1. Calculate the amount to be recorded

Q128: Scape Corp. manufactures telephony equipment. Scape leased

Q129: Big Bucks leased equipment to Shannon Company

Q130: Required:

1. Calculate the amount to be recorded

Q132: The Bobo Company leased equipment from Bolinger

Q133: Tolmeka Leasing purchased equipment for $3,000,000 and

Q134: Each of the independent situations below describes

Q135: Northwestern Edison Company leased equipment from Hi-Tech

Q136: To raise operating funds, Combs Corporation sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents