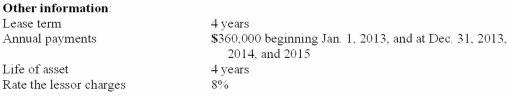

Neely BBQ leased equipment from Smoke Industries on January 1, 2013. Smoke Industries had manufactured the equipment at a cost of $810,000. Its cash selling price and fair value is $1,287,756. Both companies employ the lease ASU.  Required:

Required:

1. Prepare the appropriate entries for Neely BBQ (Lessee) on January 1, 2013, and December 31, 2013.

2. Prepare the appropriate entries for Smoke Industries (Lessor) on January 1, 2013, and December 31, 2013. Assume that Smoke Industries determined that it does retain exposure to significant risks or benefits associated with the equipment.

3. Prepare the appropriate entries for Smoke Industries (Lessor) on January 1, 2013, and December 31, 2013. Assume that Smoke Industries determined that it does not retain exposure to significant risks or benefits associated with the equipment.

Correct Answer:

Verified

Q120: On June 30, 2013, Blue, Inc., leased

Q121: You and a colleague are reviewing a

Q122: Diablo Company leased a machine from Juniper

Q123: Present value of periodic lease payments

Q124: Merlin Co. leased equipment to Houdini Inc.

Q126: Nickle leased equipment to Back Company on

Q127: Required:

1. Calculate the amount to be recorded

Q128: Scape Corp. manufactures telephony equipment. Scape leased

Q129: Big Bucks leased equipment to Shannon Company

Q130: Required:

1. Calculate the amount to be recorded

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents