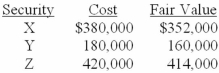

Hobson Company bought the securities listed below during 2012. These securities were classified as trading securities. In its December 31, 2012, income statement Hobson reported a net unrealized loss of $13,000 on these securities. Pertinent data at the end of December 2013 is as follows:  What amount of loss on these securities should Hobson include in its income statement for the year ended December 31, 2013?

What amount of loss on these securities should Hobson include in its income statement for the year ended December 31, 2013?

A) $41,000.

B) $54,000.

C) $13,000.

D) $0.

Correct Answer:

Verified

Q26: Which category completely excludes equity securities?

A)Securities available

Q39: Which of the following investment securities held

Q40: Under IAS No. 39, transfers of debt

Q44: Anthers Inc. bought the following portfolio of

Q45: All investment securities are initially recorded at:

A)Cost.

B)Present

Q46: Nichols Enterprises has an investment in 25,000

Q48: What is the effect on a company's

Q57: Holding gains and losses on trading securities

Q58: When an equity security is appropriately carried

Q65: Investments in securities to be held for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents