Assume that, on January 1, 2013, Sosa Enterprises paid $3,000,000 for its investment in 36,000 shares of Orioles Co. Further, assume that Orioles has 120,000 total shares of stock issued and estimates an eight-year remaining useful life and straight-line depreciation with no residual value for its depreciable assets. At January 1, 2013, the book value of Orioles' identifiable net assets was $7,000,000, and the fair value of Orioles was $10,000,000. The difference between Orioles' fair value and the book value of its identifiable net assets is attributable to $1,800,000 of land and the remainder to depreciable assets. Goodwill was not part of this transaction.

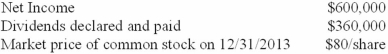

The following information pertains to Orioles during 2013:  What amount would Sosa Enterprises report in its year-end 2013 balance sheet for its investment in Orioles Co.?

What amount would Sosa Enterprises report in its year-end 2013 balance sheet for its investment in Orioles Co.?

A) $3,200,000.

B) $3,180,000.

C) $3,135,000.

D) $3,027,000.

Correct Answer:

Verified

Q107: If the fair value of a held-to-maturity

Q116: When an impairment of an equity investment

Q117: Assume that Nichols concludes that the Holly

Q118: Wang Corporation purchased $100,000 of Hales Inc.

Q119: Which of the following is not true

Q121: On January 1, 2013, Hoosier Company purchased

Q122: On March 1, 2013, Navy Corporation used

Q123: Which of the following is not true

Q124: Cortez Associates purchased a debt investment that

Q125: Assume that Nichols concludes that the Holly

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents