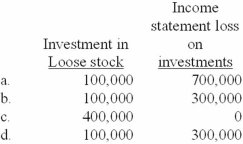

Dicker Furriers purchased 1,000 shares of Loose Corporation stock on January 10, 2012, for $800 per share and classified the investment as securities available for sale. Loose's market value was $400 per share on December 31, 2012, and the decline in value was viewed as temporary. As of December 31, 2013, Dicker still owned the Loose stock whose market value had declined to $100 per share. The decline is due to a reason that's judged to be other than temporary. Dicker's December 31, 2013, balance sheet and the 2013 income statement would show the following:

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q131: Which of the following is not true

Q134: Cain Corporation owns $10,000 of IBM bonds.

Q135: Which of the following is a criterion

Q136: FKG Inc. carries the following investments on

Q137: The Stevens Company purchased a debt investment

Q138: Jackson & Sons purchased a debt investment

Q139: The following transactions occurred during the year

Q141: What was the after-tax realized gain or

Q142: In 2012, Kirby made two adjustments to

Q144: Bentz Corporation bought and sold several securities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents