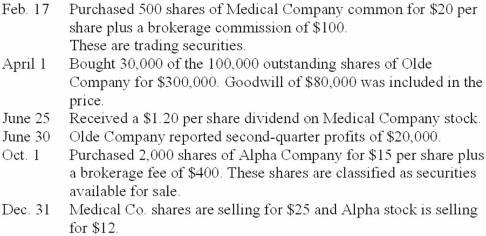

Jackson Company engaged in the following investment transactions during the current year.  Required:

Required:

Prepare the appropriate journal entries to record the transactions for the year including year-end adjustments. Show calculations.

Correct Answer:

Verified

Q131: Which of the following is not true

Q139: The following transactions occurred during the year

Q141: What was the after-tax realized gain or

Q142: In 2012, Kirby made two adjustments to

Q144: Bentz Corporation bought and sold several securities

Q146: During 2013, Largent Enterprises purchased stock as

Q147: Assuming a constant tax rate of 40%,

Q148: On January 1, 2013, American Corporation purchased

Q149: On July 1, 2013, Silverwood Company purchased

Q150: On March 17, 2012, Union Corporation purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents