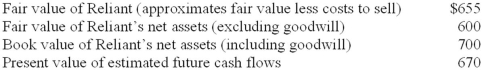

Kingston Corporation has $95 million of goodwill on its books from the 2011 acquisition of Reliant Motors. At the end of its 2013 fiscal year, management has provided the following information for its required goodwill impairment test ($ in millions) :  Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

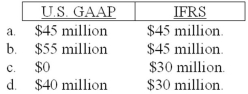

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Q88: Canliss Mining uses the retirement method to

Q89: According to International Financial Reporting Standards, biological

Q90: The replacement of a major component increased

Q90: Required:

Compute depreciation for 2013 and 2014 and

Q92: According to International Financial Reporting Standards, the

Q94: According to International Financial Reporting Standards, the

Q95: According to International Financial Reporting Standards, the

Q96: The normal treatment of litigation costs to

Q97: Required:

Compute depreciation for 2013 and 2014 and

Q98: Required:

Compute depreciation for 2013 and 2014 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents