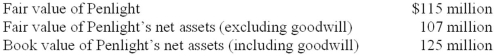

In 2011, Quasar Ltd. acquired all of the common stock of Penlight Laser for $124 million. The fair value of Penlight's identifiable tangible and intangible assets totaled $205 million, and the fair value of liabilities assumed by Quasar was $95 million. Quasar performed a required goodwill impairment test at the end of its fiscal year ended December 31, 2013. Management has provided the following information:  Required:

Required:

1. Determine the amount of goodwill that resulted from the Penlight acquisition.

2. Determine the amount of goodwill impairment loss that Quasar should recognize at the end of 2013, if any.

3. If an impairment loss is required, prepare the journal entry to record the loss.

Correct Answer:

Verified

Q128: The loss would appear in the income

Q129: Notsofast Inc. acquired land for $500,000 on

Q130: Entry to record the impairment loss:

Q131: On June 30, 2011, Mobley Corporation acquired

Q132: Depreciation for 2013: $350,000 ÷ 7 =

Q134: 2011 amortization: $4,000,000 ÷ 8 = $500,000

Q136: An impairment loss is indicated because the

Q138: Impairment loss is the difference between book

Q189: In 2017, Dooling Corporation acquired Oxford Inc.

Q203: Briefly explain the following statement. Depreciation is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents