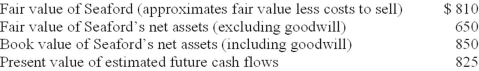

Kentfield Corporation has $260 million of goodwill on its book from the 2010 acquisition of Seaford Shipping. At the end of its 2013 fiscal year, management has provided the following information for a required goodwill impairment test ($ in millions):  Required:

Required:

Assuming that Seaford is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, determine the amount of goodwill impairment loss that Kentfield should recognize according to U.S. GAAP and International Financial Reporting Standards.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q134: 2011 amortization: $4,000,000 ÷ 8 = $500,000

Q136: An impairment loss is indicated because the

Q138: Impairment loss is the difference between book

Q140: On March 30, 2013, Calvin Exploration purchased

Q189: In 2017, Dooling Corporation acquired Oxford Inc.

Q203: Briefly explain the following statement. Depreciation is

Q206: Briefly discuss why straight-line is the most

Q213: Briefly explain the disclosures that are required

Q217: Briefly discuss the factors that determine the

Q219: Briefly differentiate between activity-based and time-based allocation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents