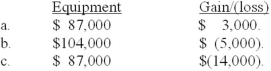

Bloomington Inc. exchanged land for equipment and $3,000 in cash. The book value and the fair value of the land were $104,000 and $90,000, respectively. Bloomington would record equipment and a gain/(loss) of:

A) Option a

B) Option b

C) Option c

D) None of the above is correct.

Correct Answer:

Verified

Q42: In Case A,Grand Forks would record the

Q44: Assuming that the exchange lacks commercial substance,Alamos

Q49: In Case A,Pensacola would record the new

Q50: Donated assets are recorded at:

A) Zero (memo

Q55: In computing capitalized interest, average accumulated expenditures:

A)Is

Q58: P. Chang & Co. exchanged land and

Q59: Average accumulated expenditures:

A)Is an approximation of the

Q61: Average accumulated expenditures for 2013 was:

A)$300,000.

B)$350,000.

C)$500,000.

D)$400,000.

Q62: What is the amount of interest that

Q64: Interest may be capitalized:

A) On routinely manufactured

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents