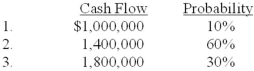

Calegari Mining paid $2 million to obtain the rights to operate a coal mine in Tennessee. Costs of exploring for the coal deposit totaled $1,500,000, and development costs of $5 million were incurred in preparing the mine for extraction, which began on January 2, 2013. After the coal is extracted in approximately five years, Calegari is obligated to restore the land to its original condition. The company's controller has provided the following three cash flow possibilities for the restoration costs:  The company's credit-adjusted, risk-free rate of interest is 7%, and its fiscal year ends on December 31.

The company's credit-adjusted, risk-free rate of interest is 7%, and its fiscal year ends on December 31.

Required:

1. What is the initial cost of the coal mine? (Round computations to nearest whole dollar.)

2. How much accretion expense will Calegari report in its 2013 and 2014 income statements?

3. What is the carrying value (book value) of the asset retirement obligation that Calegari will report in its 2013 and 2014 balance sheets?

4. Assume that actual restoration costs incurred in 2018 totaled $1,370,000. What amount of gain or loss will Calegari recognize on retirement of the liability?

Correct Answer:

Verified

Q90: During the current year, Brewer Company acquired

Q91: In accounting for oil and gas exploration

Q92: Schefter Mining operates a copper mine in

Q93: In its 2013 annual report to shareholders,

Q94: During the current year, Peterson Data Corporation

Q97: During the current year, Compton Crate Corporation

Q98: On August 15, 2013, Willis Inc. acquired

Q99: Under International Financial Reporting Standards, development expenditures

Q100: Cromartie Ltd. prepares its financial statements according

Q179: Match each of the following statements with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents