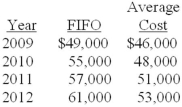

Ramsgate Company has used the FIFO method for inventory valuation since it began business in 2009, but has elected to change to the average cost method starting in 2012. Year-end inventory valuations under each method are shown below:  Required:

Required:

How, and when, would Ramsgate reflect the change in accounting principle in its financial statements (ignore income taxes)?

Correct Answer:

Verified

Q110: Briefly explain the differences between U.S. GAAP

Q112: If market price at year-end is less

Q114: Charleston Company has elected to use the

Q115: In the year 2013, the internal auditors

Q116: Cindy Lou Linens uses the conventional retail

Q118: The following disclosure note appeared in the

Q120: If market price on purchase date declines

Q141: The gross profit method and retail method

Q142: Briefly explain the financial reporting required when

Q153: Briefly explain the financial reporting required when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents