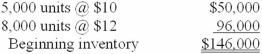

Bettencourt Clothing Corporation uses a periodic inventory system and the LIFO cost method. The company began 2013 with the following inventory layers (listed in chronological order of acquisition):  During 2013, 20,000 units were purchased for $15 per unit. Sales for the year totaled 30,000 units at various prices, leaving 3,000 units in ending inventory.

During 2013, 20,000 units were purchased for $15 per unit. Sales for the year totaled 30,000 units at various prices, leaving 3,000 units in ending inventory.

Required:

1. Calculate cost of goods sold for 2013.

2. Determine the amount of LIFO liquidation profit that the company must report in a disclosure note to its 2013 financial statements, assuming the amount is material. Assume an income tax rate of 40%.

Correct Answer:

Verified

Q107: On January 1, 2013, the National Furniture

Q108: On January 1, 2012, ECT Co. adopted

Q109: Chavez Inc adopted dollar-value LIFO on January

Q110: Modern Day Appliances, Inc. is a wholesaler

Q111: The table below contains selected financial information

Q114: Required:

The disclosure note indicates an inventory liquidation

Q115: On January 1, 2012, RAY Co. adopted

Q116: What additional income tax payments did the

Q117: The following information comes from the 2010

Q168: Briefly describe why companies that use perpetual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents