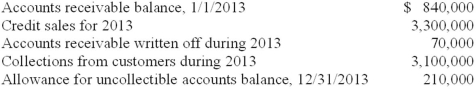

The following information relates to Halloran Co.'s accounts receivable for 2013:  What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?

What amount should Halloran report for accounts receivable, before allowances, at December 31, 2013?

A) $1,040,000.

B) $970,000.

C) $760,000.

D) None of the above.

Correct Answer:

Verified

Q35: Cash that is restricted and not available

Q36: If Wilson reports under IFRS, its 12/31/2013

Q37: What entry would Oswego make on April

Q38: If Wilson reports under U.S. GAAP, its

Q40: What entry would Cherokee make on November

Q42: Calistoga's adjusted allowance for uncollectible accounts at

Q46: What entry would Cherokee make on December

Q63: Accounts receivable are normally reported at the:

A)

Q69: The allowance for uncollectible accounts is a:

A)

Q71: Collection of accounts receivable that previously have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents