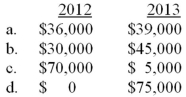

Assuming BCC used the completed contract method to recognize revenue, what would gross profit have been in 2012 and 2013 (rounded to the nearest thousand) ?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q102: Sullivan should recognize revenue for the two

Q104: Assuming BCC used the cost recovery method

Q105: GAAP that covers revenue recognition for multiple-part

Q106: Assume that at the time of signing

Q108: Assuming BCC uses the percentage-of-completion method of

Q109: Dowling's 2013 average collection period is (rounded):

A)50

Q111: Dowling's 2013 profit margin is (rounded):

A)17.4%.

B)18.5%.

C)18.0%.

D)16.5%.

Q112: Assume that Steffi paid the $50,000 in

Q226: Assume that Steffi signed a $50,000 installment

Q236: "VSOE" is necessary to separately recognize revenue

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents