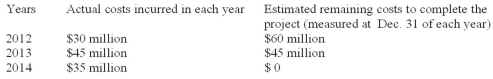

Beck Construction Company began work on a new building project on January 1, 2012. The project is to be completed by December 31, 2014, for a fixed price of $108 million. The following are the actual costs incurred and estimates of remaining costs to complete the project that were made by Beck's accounting staff:  Required: What amount of gross profit (or loss) would Beck record on this project in each year under the percentage-of-completion method? Place answers in the spaces provided below and show supporting computations.

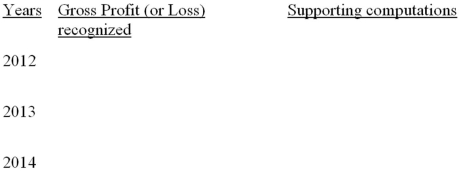

Required: What amount of gross profit (or loss) would Beck record on this project in each year under the percentage-of-completion method? Place answers in the spaces provided below and show supporting computations.

Correct Answer:

Verified

Q93: Stayman Associates has sold a good to

Q148: Big Bear Company deals in distressed properties

Q149: Assume that Beavis uses the completed contract

Q150: Assume ID can estimate uncollectible accounts accurately,

Q151: Beck Construction Company began work on a

Q152: Which of the following is not an

Q155: Carpenter sells wholesale to McGuire Inc. under

Q156: Assume ID cannot estimate uncollectible accounts accurately

Q157: Assume that Beavis uses the completed contract

Q158: Assume that Beavis uses the percentage-of-completion method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents