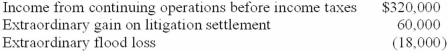

Paris Company reported the following items in its December 31, 2013, year-end adjusted trial balance:  Paris is subject to a 40% income tax rate.

Paris is subject to a 40% income tax rate.

Required:

Prepare the December 31, 2013, income statement for Paris Company starting with income from continuing operations before income taxes.

Correct Answer:

Verified

Q45: Reconciliation between net income and comprehensive income

Q53: Cash flows from investing do not include

Q60: Schneider Inc. had salaries payable of $60,000

Q63: Comprehensive income is the change in equity

Q63: Scenario 1: Assume that Jacob sold the

Q64: Expenses in an income statement prepared under

Q65: Scenario 2: Assume that Jacob had not

Q66: Required:

Prepare a single-step income statement with basic

Q68: Operating cash outflows would include:

A) Purchase of

Q83: Arrow Printers paid $2,000 interest on short-term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents