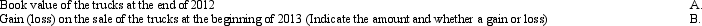

Sheffield Ridge Co.purchased new trucks at the beginning of 2012 for $600,000.The trucks had an estimated life of 4 years and an estimated residual value of $50,000.Sheffield Ridge uses straight-line depreciation.At the beginning of 2013,Sheffield Ridge sold the trucks for $480,000 and purchased new trucks for $700,000.Determine the following amounts:

Correct Answer:

Verified

Q171: Glitch Company incurred the following costs during

Q172: Several years ago,Fair Play Company purchased a

Q176: Fill in the table shown below indicating

Q177: Greeley,Inc.purchased slot machines at the beginning of

Q179: Below are several accounts and balances from

Q182: Marrow Company has a large portion of

Q187: Explain how the costs associated with operating

Q188: Explain what costs are included in the

Q194: Distinguish between current assets and operating assets.

Q197: What is the relationship between the depreciation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents