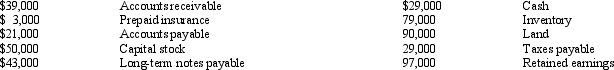

Guinther & Sons,Inc. Guinther & Sons,Inc.a retailer of men's clothing,earned a net profit of $77,000 for 2014.The balance sheet for Guinther & Sons includes the following items: Read the information for Guinther & Sons,Inc.The average current ratio for stores such as Guinther & Sons is 2.4 to 1.What does this comparison tell you about its liquidity?

Read the information for Guinther & Sons,Inc.The average current ratio for stores such as Guinther & Sons is 2.4 to 1.What does this comparison tell you about its liquidity?

A) It is more liquid than its competitors

B) It has more long-term assets than its competitors

C) Since a rule of thumb for current ratios is 2 to 1,neither Nadia & Sisters nor its competitors is liquid.

D) Nadia & Sisters is more profitable than its competitors.

Correct Answer:

Verified

Q29: Guinther & Sons,Inc. Guinther & Sons,Inc.a retailer

Q33: For several years,Shaun Corporation has had a

Q35: Use Rizwi Corporation's list of accounts at

Q36: Rosu Company has total current assets of

Q36: Which of the following accounts are normally

Q68: One significant difference between a classified and

Q71: Which financial statement reports information helpful in

Q73: Which of the following statements is true

Q74: Which of the following would not be

Q80: Which set of items below are current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents